Executive Orders, Immigration, and Inflation: Trump’s Policy Remix

Donald Trump’s first days in office have brought a dizzying number of executive orders. Many of these orders will not have economic impacts, and still others may not actually get enacted whether because of court challenges or limited funding. Some though are worth watching from an investment perspective. Below we take a deeper dive into one area that’s gotten a lot of focus: immigration.

Labor policy

Whatever your views on immigration policy, immigrants have had a large impact on the US labor market. And I understand that passions run deep on both sides of this debate. For that reason, I believe it’s important to look at the facts dispassionately and understand the potential economic impacts of policy decisions.

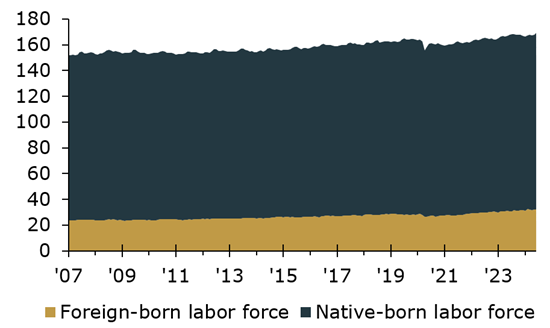

Over the last few years, as American companies have grown, they’ve looked to hire more workers, making the labor market among the tightest we’ve seen since the 1960s. With so many jobs available, the US economy drew in many foreign-born workers including those who are here working legally and those who are undocumented. Interestingly, the number of foreign-born workers grew even during Trump’s first presidency. Today, foreign-born workers make up 19% of the US labor force at a time when some employers continue to struggle to hire qualified workers.

Civilian Labor Force Level by Birth Country (Millions of people)

Data includes population 16 years and older. Not seasonally adjusted. Source: Bureau of Labor Statistics and Kestra Investment Management. Data as of June 2024.

In his first few days in office, Trump signed 26 executive orders, more than any US president, 6 of which concern immigration. The impact of these orders would most likely lower the number of undocumented migrants coming into the US and probably make it more difficult for foreigners to enter the US legally resulting in the net effect of lowering the number of available workers. Fewer workers mean business owners will likely need to pay higher wages to get and keep new employees, and higher wages means higher prices of goods which would ultimately drive up inflation.

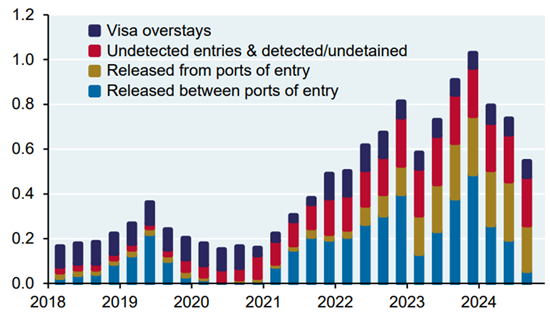

It’s worth noting that the number of undocumented immigrants has already started to fall after peaking in the fourth quarter of 2023. So, in some ways, the issue has begun to be corrected on its own. In addition, ICE removed more migrants per year during Obama’s administration than under Trump’s first administration, despite Trump’s rhetoric. In his second term, there may again be a disconnect between what Trump says and what happens.

Inflow of Undocumented Immigrants to the US (Millions of people per quarter)

Source: San Francisco Fed, November 2024.

Immigration and Customs Enforcement (ICE) Removals by Presidency (Monthly removals and returns)

Source: TRAC (Syracuse), ICE, JPMAM, September 2024.

While these policies may have less of an impact than expected, there are some areas that are likely to feel more of a strain. Border states such as California and Texas, plus Nevada which tends to hire a lot of foreign-born workers, will likely be most impacted, as will the construction and agricultural sectors. The key question, at least for the broader economy, will be how many individuals these new policies impact. For that, we’ll need to stay tuned.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. Does not offer tax or legal advice.