Blogs

Beyond Big Tech: The Global Surge in AI Adoption and Implications for Investors

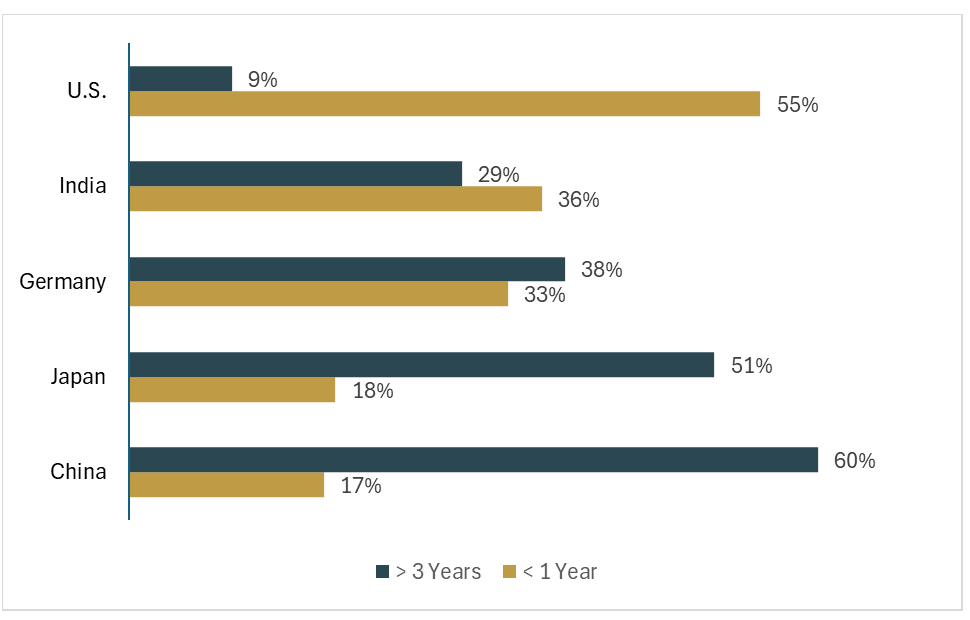

Explore how artificial intelligence adoption is accelerating across industries and markets worldwide, reshaping investment opportunities and future growth trends.

Honored by Our Community: Platinum Recognition from CommunityVotes

Ashwood Financial Partners was named the Platinum Winner in the Financial Advisors category by CommunityVotes in Richmond, Virginia. This community-driven recognition reflects the trust of local clients, friends, and partners. Learn how Ashwood’s relationship-focused approach to wealth management and financial planning continues to serve Richmond families and businesses.

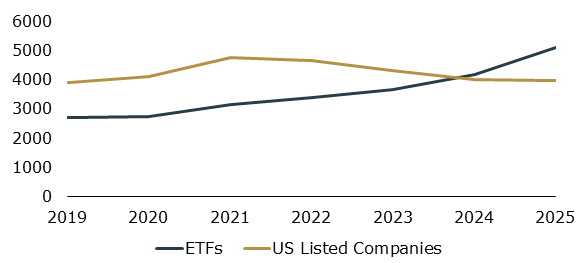

The Rise of Active ETFs and the Implications for Investors

Active ETFs are reshaping the investment landscape. Once dominated by low-cost passive strategies, the ETF market now features active management, higher fees, and growing complexity. Learn how this structural shift impacts investors, why due diligence matters more than ever, and how advisors can navigate an increasingly crowded ETF universe.

Money with Murphy: Will 2026 Finally Break Big Tech’s Grip on CapEx?

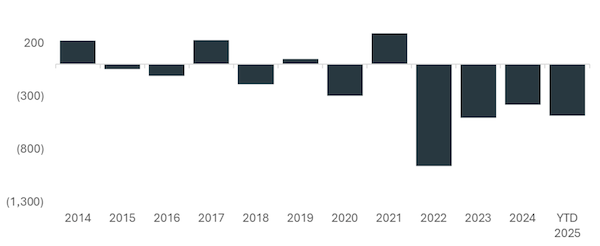

After years of record investment by Big Tech and hyperscalers, 2026 may mark a turning point for capital spending. In this episode of Money with Murphy, Kara Murphy breaks down how the One Big Beautiful Bill Act (OBBBA) could spark a broader CapEx boom beyond technology. Learn why expanding business investment is essential for long-term productivity, earnings growth, and a healthier stock market in 2026 and beyond.

Thriving in Uncertainty: Market Review and Outlook

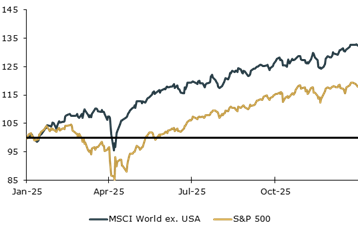

After a third straight year of double-digit gains, markets enter 2026 with strong momentum and rising uncertainty. This Markets in a Minute review breaks down 2025’s top market trends, global leadership shifts, sector performance, and why diversification matters more than ever in a changing policy and economic landscape.

Money with Murphy: Market Resilience in the Face of Headwinds

In this video market update, Kara Murphy, CFA of Kestra Investment Management explores how financial markets have remained resilient despite economic headwinds. She examines the impact of inflation, interest rates, and policy uncertainty while highlighting the importance of diversification, risk management, and long-term investment discipline. This insight helps investors understand today’s market environment and why staying focused on long-term goals is critical during periods of volatility.

Celebrating One Year with Chris Milligan at Ashwood Financial Partners

Ashwood Financial Partners celebrates one year with Chris Milligan, recognizing his investment leadership and first-place Virginia State Fair win.

Money with Murphy: 2025 Year in Review

Markets covered a lot of ground in 2025 but remained resilient. Tariff announcements in the first quarter of the year led to a significant drawdown and volatility across the globe. Yet, markets immediately bounced back to reach record highs with strong earnings growth fueled by AI-driven technology companies. Kara’s year in review covers the year’s biggest stories.

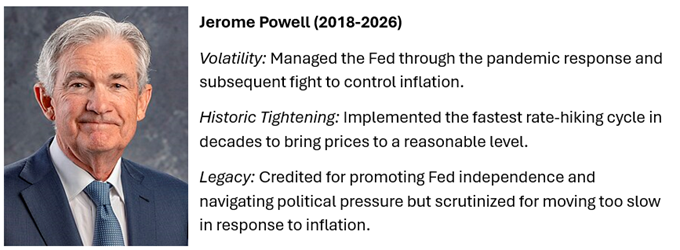

The Fed’s Final Act of 2025: More Rate Cuts?

As the Federal Reserve heads into its final meeting of 2025, investors are watching closely to see whether additional rate cuts are coming. With inflation still above target, labor markets showing signs of weakness, and political pressure intensifying, Fed Chair Jerome Powell faces a defining moment for both the economy and his legacy. This Markets in a Minute explores the competing forces shaping monetary policy, the growing divide within the Fed, and what Powell’s final decisions could mean for markets in 2026.

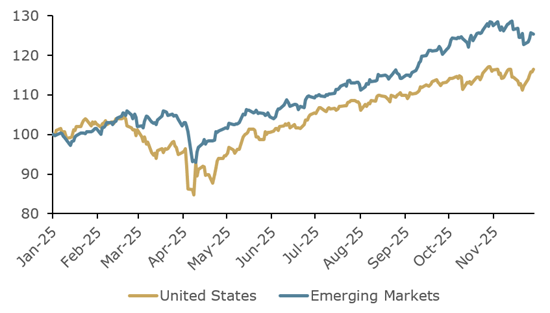

Worried about an AI Bubble? The Case for Emerging Markets

Worried that today’s AI-driven tech rally may be forming a bubble? Emerging markets are quietly delivering some of the strongest returns of 2025—and offering portfolio diversification when investors need it most. With the MSCI Emerging Markets Index up more than 25% year-to-date, countries like India, South Korea, and Mexico are benefiting from faster growth, attractive valuations, a rising middle class, and a weaker U.S. dollar. We break down why emerging markets may be a smart complement to AI-heavy portfolios, what risks to watch, and whether this leadership shift can last into 2026.

Gratitude in the Markets: What Investors Can Be Thankful For

As families set tables and prep turkeys for the Thanksgiving holiday, we are reminded that investors have plenty to be thankful for, including market strength despite tariffs, robust corporate earnings and an accommodative Federal Reserve.

Money with Murphy: The Popularity of Private Credit - Wall Street’s Latest Trending Asset Class

“When you see one cockroach, there’s probably more,” said JPMorgan CEO Jamie Dimon in an Oct. 14 comment referring to cracks he’s seeing in the banking sector. The, now, infamous cockroach quote sparked important debate about the $1.6 trillion private credit market, which has grown 300% over the past decade while delivering strong risk-adjusted returns. Understanding both the opportunities and risks of this evolving asset class is essential for investors looking to tap into one of the market’s most compelling areas of growth.

Déjà Vu: Low-Quality Stocks Are Rallying Again, but Time Isn’t on Their Side

After a year of stunning gains for low-quality, small-cap stocks, investors may be wondering if fundamentals still matter. History says yes. This week’s Markets in a Minute explores what’s fueling the rally, why it resembles the meme-stock craze, and why quality—not hype—remains the key to long-term investing success.

Common End-of-Year Tax Client Considerations

As the year winds down, smart investors revisit portfolios through a tax-efficient lens. From rebalancing concentrated stock positions to avoiding mutual fund “phantom gains” and setting a capital-gains budget, year-end tax planning can help reduce surprises and align investments with long-term goals.

Money with Murphy: Solid-footing: Stability, New Highs and the Road to 2026

Markets regained their footing in the third quarter, with stocks, bonds, commodities, and real estate all posting gains and nearly every S&P 500 sector ending the period higher. A stable U.S. dollar, new tax legislation, and easing tariff concerns helped fuel the rally, especially in tech and emerging markets. At the same time, labor market softening and a Fed rate cut supported bonds, while investors shifted focus to upcoming earnings guidance on AI spending and tariffs. With more rate cuts expected, the job market and CEO outlooks will be key drivers heading into 2026.

Running for a Cause: Ashwood Financial Partners at the Good Medicine 5k

Ashwood Financial Partners ran the Good Medicine 5K to support the Free Clinic of Powhatan, combining team building with giving back to the community.

No Place Like Home: Pain Points in the Housing Market and the Path Ahead

The U.S. housing market faces persistent affordability challenges despite recent shifts in supply and mortgage rates. In this Markets in a Minute, we examine why homeownership has become harder for first-time buyers, how the lock-in effect is reshaping supply, and what rising construction costs mean for the future of single-family housing. Explore the key drivers, risks, and potential policy solutions shaping the path ahead

Money with Murphy: What Q2 Earnings Tells us about AI’s Impact

This quarter’s earnings season is proving to be one of the strongest in recent years—and the common thread tying it together is artificial intelligence. In the latest Money with Murphy, Kara explores how AI’s influence extends far beyond the tech sector, creating ripple effects across industries like industrials and manufacturing. With rising guidance and shifting corporate investments, we may be seeing the early signs of a broader economic transformation.

Tariff Turmoil and Rebound: Second Quarter Market Review and Outlook

Second Quarter Recap: Volatility, Resilience, and the Case for Diversification

Markets delivered a dramatic second quarter—starting with tariff turmoil and ending in record territory. The S&P 500 posted a 6% gain year-to-date, while international equities and bonds outperformed in surprising fashion. Behind the headlines, solid economic data, easing inflation, and rebounding bond markets helped lift investor sentiment. But persistent risks—from policy uncertainty to geopolitical tensions—are keeping markets on edge. In this quarter’s recap, we explore the key drivers behind the market’s V-shaped recovery and why diversification remains as important as ever for long-term investors.

Summer Series: Team Member Spotlight

Chris Milligan, CFA brings nearly 15 years of experience and a passion for markets to Ashwood’s investment team. A Braves fan, gardener, and firm believer in leading with attitude, effort, and integrity, Chris continues to make a lasting impact on our clients and our firm.