January 2022 Commentary

Hope all is well. I am keeping a close eye on the global capital markets and recent decline in equities. As a fiduciary advisor with over 20 years of experience working with investors, I have helped guide clients through various cycles of market swings. Based on my experience, patient investors tend to be the most successful investors. While the recent downturn could be uncomfortable for you, I am here to help you “drown out the noise” and take the emotion out of investing so that you will achieve your financial and investment goals.

The recent selloff in the equities markets has primarily been driven by fears that the Federal Reserve will be more aggressive (“Hawkish”) than previously expected in raising interest rates and Quantitative Tightening--the opposite of Quantitative Easing where the Fed injects money into the economy to expand economic activity. I believe that the Fed will tone down its Hawkish rhetoric which should help reverse the downward pressure on the markets. One key event that I am monitoring is Wednesday’s Federal Open Market Committee (FOMC) meeting where Fed Chairman Powell could ease off of his intense Hawkish rhetoric, thus supporting a rebound in the markets.

Overall, while inflation, a rising interest rate environment, Covid restrictions, and supply chain issues remain headwinds, I believe that the fundamentals of the U.S. economy remain intact and are supported by: solid economic growth, a low interest rate environment, improving unemployment trends, and robust consumer spending. As such, I view the recent decline in global equities as temporary. Shocks from external forces occur and historically, the market has rebounded, so the recent downturn in markets is not uncharted territory.

As the chart below details, intra-year declines in the markets are normal and should be expected as part of investing. Since 1980, the S&P 500 has averaged a 14% intra-year decline and ended the calendar year in positive territory over 75% of the time. This recent decline in equities is normal, and sometimes market “resets” can be healthy for investors.

Source: JP Morgan Asset Management

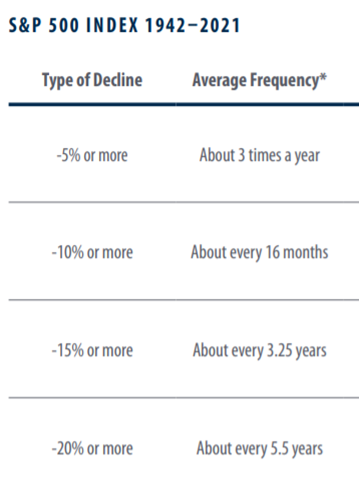

As the table below highlights, the S&P 500 has experience a 10%+ decline (“Market Correction”) about every 16 months, so the recent decline from record highs is nothing new.

While past performance is not a guarantee of future results, the market has historically ALWAYS rebounded from declines and reached new record highs.

Source: First Trust

I view that looking at the market’s overall resiliency through several major crises and events helps to gain a fresh perspective on the benefits of investing for the long-term.

Source: First Trust

Turning to the outlook for the economy, recent forward-looking economic indicators are positive overall, signaling that the global economic outlook continues to improve—a positive for stocks and other assets.

Below I compare the most recent Economic “Speedometer” to October 2008. Green is positive, yellow is neutral, and red is negative. As the indicators between the two periods show, the current economic environment, although in recovery mode from the COVID pandemic, remains healthy and should help drive equities higher.

Source: City National Rochdale

I will continue to monitor the markets and provide you with relevant updates that could impact your investments and accounts. As always, please contact me if you would like to review your accounts, discuss the markets, and/or review your retirement track. You can use the highlighted link below to schedule time for a review.

Have a great week. I’ll end the email with the 2022 outlook (pictured below) from the Economics team at First Trust.

Ashby

Source: First Trust