Opportunity Knocks: Market Review and Outlook

In 2024, the stock market showed once again that it can climb a proverbial wall of worry. The year was marked by a number of headline-grabbing developments that had the potential to derail the market’s momentum but ultimately didn’t make much of a dent.

The S&P 500 index had a stellar year – finishing up 24% – despite an unpredictable and unprecedented presidential election, a widening Middle East conflict and other geopolitical risks, and fewer Federal Reserve interest rate cuts than investors had anticipated. The S&P 500 marked its second year in a row with a gain of more than 20%.

The rally was fueled by a resilient domestic economy, rate cuts (even if fewer than expected) and impressive gains for large growth stocks, particularly the Magnificent 7 giants, many of whom are at the forefront of artificial intelligence. (For more 2024 highlights, watch this edition of Money with Murphy.)

With last year’s strong performance behind us, the question is: What lies ahead? In this week’s Markets in a Minute, we offer our take on this question and a glimpse of where we see opportunity this year.

Rinse and Repeat?

After two consecutive years of extraordinary gains driven by a handful of names, many investors are wondering whether the market will stage a repeat performance in 2025. We expect things to play out somewhat differently.

Given the positive outlook for economic growth and corporate earnings, we remain constructive on the overall market. That said, gains of more than 20% a year are fantastic but not normal. The S&P 500 has historically delivered an average annual return of less than 10%, and even lower when adjusted for inflation.

A Better Balance

It’s also worth noting that we’re left with a very lopsided market after the last couple of years. The 10-largest stocks in the S&P 500 now represent a whopping 36% of the index’s market capitalization, the highest level since 1990 and nearly 10 percentage points higher than in 2000.

Their valuations have also been getting somewhat stretched. Price-to-forward earnings ratios for the top 10 are roughly 29 times, versus 20 times for the rest of the names in the index.

Unlike the run-up to 2000, when the so-called dot-com bubble burst, the recent tech rally has been underpinned by strong earnings growth, which is, of course, good news. But, as the year progresses, analysts expect earnings to broaden out, with smaller names in the S&P 500 leading the charge.

Mag 7 vs. S&P 500 ex. Mag 7 Quarter Earnings Per Share Growth (%)

Q125 – Q425 represent estimates. Forward-looking estimates may not come to pass. Source: Ned Davis Research and Kestra Investment Management. Index: S&P 500. Data as of December 9, 2024.

Where do we see opportunity in a shifting landscape?

Companies that are outside the Magnificant 7 club offer investors plenty of opportunities, with lower valuations and accelerating earnings. For instance, mid-cap stocks, typically established companies with room to grow, offer a stark contrast to the Mag 7, although careful stock-selection is important. The weight of mid-cap stocks in the Russell 1000 Index (about 22%) is at its lowest level since the 1960s. Despite recent underperformance, mid-caps have actually outperformed large-caps over the last 25 years or so. What’s more, their benchmark, the Russell Midcap Index, is far more diversified from a sector perspective than larger-cap indices, i.e., the S&P 500 and the Russell 1000.

Another Disappointing Year for Bonds

Unfortunately, bonds have yet to get their mojo back. In 2024, the broad fixed-income market gained a little more than 1%, marking a third straight year of disappointing returns despite last year’s rate cuts. (Bond prices tend to rise when rates fall and vice versa.)

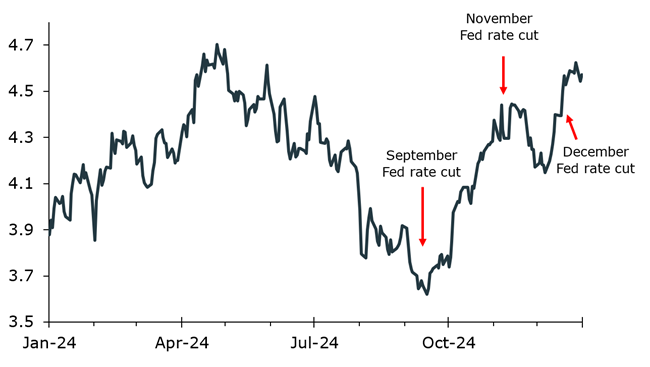

Bonds suffered partly because the Fed didn’t cut rates as quickly or as deeply as investors had anticipated and because inflation remained stubborn. In fact, the 10-year Treasury yield has risen more than 100 basis points (1 percentage point) since the Fed first began cutting rates in September 2024.

Where do bonds go from here?

As in 2024, the pace of Fed rate cuts will have a big impact on how the bond market performs this year. Currently, the market is only expecting 1-2 rate cuts this year, a big downshift in expectations from a few months ago, when as many as four rate cuts were forecasted in their September projections. Long-term rates will also be heavily influenced by inflation expectations, which have risen at the start of the year.

While bonds have had a tough stretch, there may be a silver lining to the recent turbulence. The higher starting yields we’re seeing at the cusp of the new year suggest that forward returns should be better than those of the recent past. In theory, higher yields create more-attractive entry points for investors, allowing them to earn greater interest income (the key driver of bond returns) over time.

10-Year Treasury Yield, %

Source: Kestra Investment Management with data from FactSet of the U.S. 10-Year Treasury Yield Curve. Data as of December 31, 2024.

Policy Issues Loom Large

With a new administration about to be sworn in, investors are rightly wondering how President-elect Trump’s proposed policies will affect the U.S. economy, which has held up well despite pockets of stress caused by prolonged high borrowing costs. The labor market, for instance, is tightening somewhat but remains pretty healthy on a historic basis. And consumer confidence, while low by historical standards, has rebounded a bit lately.

The biggest questions surround proposed tax cuts, more-aggressive tariffs and government spending. On tariffs, for instance, Trump has proposed going further than has first term, including imposing a blanket 10% tariff on all imports and a 60% tariff on goods made in China. Though such tariffs would pose real risk in the near-term, but we’re less concerned about the long-term implications. Part of the reason is that presidents can implement tariffs relatively easily, but they can also reverse course without much difficulty if they determine there’s been a policy mistake. (For a deeper dive into all things tariffs, watch this edition of Money with Murphy.)

Diversification Still Matters

Right now, it’s not clear what the new administration’s ultimate policies will be. But it’s safe to say we can expect a lot of political maneuvering before the dust settles.

Given the uncertainty on key policy questions and other near-term risks, diversification remains more important than ever. In a lopsided market, it’s especially critical for investors to avoid being beholden to a narrow group of stocks — as doing so can spell trouble if those companies fall out of favor. As always, diversification is one of the best ways to manage portfolio risk and position yourself to meet long-term financial goals.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. Does not offer tax or legal advice.