Will the United Auto Workers Strike Impact the US Economy?

Last week, union workers’ contracts expired without an agreement between the union and company managements on a new contract. Lacking a resolution, UAW organizers made good on their threat to launch strikes at three different companies: Ford, GM and Stellantis, the maker of Chrysler, Jeep and Alpha Romeo.

With car prices already high, energy prices climbing, and wages in aggregate already rising faster than the Federal Reserve is comfortable with, what will the impact be for the broader economy?

Impact on Workers

After many decades of declining union membership, unionization drives have grabbed headlins over the last couple of years. Companies such as Starbucks and Amazon, not to mention Hollywood, have become targets as existing unions try to expand their reach into new areas of the economy. Some union negotiations, such as United Airlines and UPS, have been successful in raising workers’ wages and improving working conditions.

Despite these headlines, union membership in aggregate has continued to decline. Currently just 10% of American workers belong to a union, a level last seen in 1934. Interestingly, even with union membership declining, a growing number of Americans support unions.

One could argue that the auto workers’ strike is really about inflation. With car prices roughly 22% above pre-covid levels and wages 18% higher, it would be easy to assume that both workers and auto companies would feel satisfied. Instead, inflation has driven the price of a wide range of goods and services ever higher, eating into both company profit margins and the buying power of those workers.

Real Wages: Auto Workers versus All Private Sector Workers

Source: US Bureau of Labor Statistics, Bloomberg

Note: Average hourly wages of US production and nonsupervisory employees shown in July 2023 dollars.

That said, this is not just about inflation. Auto workers’ real wages have fallen by 30% since their peak in 2003, well before inflation began to rise. At the same time, real wages throughout the US have increased and, as UAW negotiators are quick to point out, auto companies’ managements have enjoyed large increases in pay, helped by a strong stock market.

Union negotiators have pinned many of their arguments on this disparity in compensation between a typical worker and the companies’ leaders. In this disparate experience, the auto companies are not unique. In aggregate, the compensation of America’s CEOs has grown to be nearly 400 times the average worker, compared to just 20 times in 1965. Given this growing disparity, workers at the auto companies and elsewhere are likely to continue to tip the scales back in their favor.

Impact on the Auto Industry

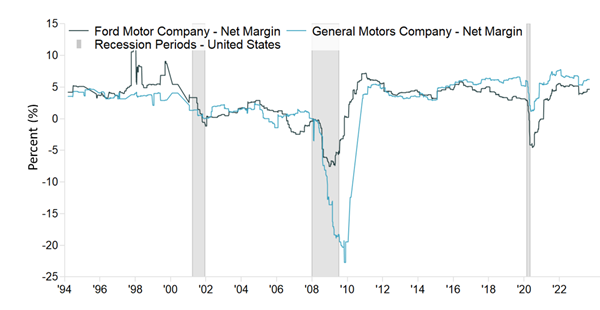

The UAW is likely emboldened by the fact that auto maker profit margins have rebounded. Though it’s worth remembering the potential fragility of the business model; it was only fifteen years ago that both GM and Ford required massive bailouts from the government in order to survive. And only three years since the pandemic interrupted supply chains and shut down factory floors, reducing the number of cars the industry could manufacture.

In the near term, fewer workers certainly mean fewer new cars and lower profits for the manufacturers. Longer term, even as production ramps up, the companies will face higher wage and benefits costs.

For now, however, the impact appears limited. The UAW strikes have focused on a handful of factories that produce midsize trucks and SUVs. While these models are among the more profitable for the auto companies, they represent a small amount of industry market share.

Ford and General Motors Net Margin

Source: Kestra Investment Management with data from FactSet. Data as of September 18, 2023.

Impact on the Broad Economy

The auto industry accounts for 3% of the US economy. While not insignificant, the industry is much less important to the overall economy than it once was. In a full strike of all auto workers over ten days, the economic toll could reach $5.5 billion between lost wages and lost profits of the auto companies and related businesses. While a large number, it pales in comparison to the overall revenue of motor vehicle and parts dealers in the US of $1.5 trillion.

Perhaps the biggest risk to the broad economy is that a prolonged strike could start to drive up car prices once again, just as gas prices are also rising. Auto inventories had begun to rebuild after a drastic decline during Covid, but they remain at about one-third of their pre-Covid levels, leaving little cushion should production fall dramatically. With fewer new cars available, the average price of a new car remains over 20% above pre-pandemic prices. Even the threat of higher prices could drive car buyers to make purchases sooner than planned, which on its own can create a sense of scarcity and further drive up prices.

The UAW strike marks a new chapter for the auto industry – one in which workers and management are more openly pitted against each other. Though both sides still appear far apart, union members seem poised to make some gains in wages and benefits. How big those gains are remains to be seen. Given that neither side can afford a protracted battle, the strikes are unlikely to drag on for an extended period of time, which also limits the broader economic impact. Workers in other industries are watching closely.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. Does not offer tax or legal advice.