Retirement Plan Advisory Services: Overview

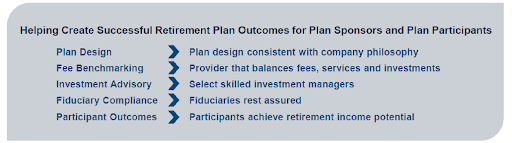

Our Mission – To partner with our clients and create successful retirement plan outcomes for plan sponsors and plan participants.

Ashwood Financial Partners is a member of Retirement Plan Advisory Group (RPAG). As a member of RPAG, we are backed by an extensive team of retirement plan experts to complement our expertise.

Together, we are a leading provider of retirement plan consulting services that help companies and their employees reach their highest potential. Our team strives to deliver highly personalized solutions, backed by unwavering ethical standards, that help plan sponsors meet fiduciary obligations and position participants for financial wellness.

RPAG works alongside Ashwood Financial Partners to help empower and equip our practice with research, technology, and delivery systems that produce measurable results. Resources include:

360° metrics on investment due diligence, plan compliance, and fee benchmarking

Shared knowledge and applied analysis

Non-alignment with any plan provider for impartial, objective, and balanced advisory services

Through our affiliation with RPAG, we have exclusive access to the most powerful and affective reporting technology to deliver high-level consulting to our clients.

Ashwood Financial Partners maintains full plan accountability through RPAG’s advanced systems and processes that are governed by a robust technology platform.

Technology planform benefits:

Proprietary Scorecard System delivers quantitative and qualitative metrics on the universe of 25,000+ funds and dozens of investment platforms

Fiduciary Fitness Program for holistic plan compliance to better protect fiduciaries and prepare plan participants

B3 Provider Analysis for unparalleled fee, service, and investment benchmarking of over 100 service providers

24/7 access to detailed plan performance reports through the Fiduciary Briefcase virtual online portal

Our Process is Driven by Our Service Model

Our service model is driven by a disciplined, documented, and structured process that incorporates plan design, investment advice, and fiduciary compliance to drive better outcomes for the plan sponsor and plan participants.

Plan Governance Assistance Process

A plan’s named fiduciary is accountable for all aspects of an organization’s retirement plan. We help you with the formal delegation of daily administrative and investment responsibilities to a retirement plan committee. We can assist you with:

Board Resolution

Committee Member Acceptances

Committee Charter

Investment Policy Statements

Quarterly Monitoring Reports

Meeting Minutes

Virtual Fiduciary File

Fiduciary Fitness Program and Fiduciary Plan Review Process

Initially, our team will conduct a Fiduciary Diagnostic on your plan that will be used to identify potential gaps pertaining to your committee’s fiduciary responsibilities. Your plan’s Fiduciary Diagnostic is then reviewed and updated on a regular basis to identify upcoming plan management responsibilities and to document when required tasks are completed. Our Fiduciary Education Modules provide the necessary resources to help inform and educate committee members regarding ERISA’s fiduciary requirements.

The Fiduciary Plan Review is an all-encompassing deliverable that provides education, documentation, and plan metrics that aims to meet fiduciary responsibilities and improve operational efficiency.

Investment Due Diligence Process

We utilize a proprietary institutional scoring system that identified skillful managers.

Our approach combines sophisticated, institutional measurement techniques with a proprietary 10-point pass/fail scoring process based on qualitative and quantitative factors. We analyze what we believe to be the individual elements of success that distinguish superior investment managers within a particular asset class.

We provide our clients with a Fiduciary Investment Review that includes recommendations for fund additions, deletions, and replacements. This Review is part of our firm’s disciplined and documented approach and contains a variety of advanced report features such as: Market Review, Scorecard, Score History, Mapping Strategies, Asset Class Comparisons, and Fund Fact Sheets.

Ongoing Communication

Our team believes that ongoing communication is crucial for successful retirement plan outcomes for plan sponsors and plan participants. As such, we keep clients abreast on the latest retirement plan news, legislative updates, and industry trends through webinars and monthly newsletters.