Beyond Big Tech: The Global Surge in AI Adoption and Implications for Investors

Key Takeaways

Artificial intelligence (AI) adoption is accelerating across sectors, industries and international markets, creating a wider opportunity set for investors. Investors are rewarding companies leaning into AI.

American companies have led the way in AI development, but usage of the technology ishigher outside the United States, particularly in emerging markets.

Companies using AI are finding some surprising benefits, including greater employee satisfaction. The cost-savings benefits aren’t as great as we might expect, but that may change over time as best-use cases become clearer.

Bring on the AI

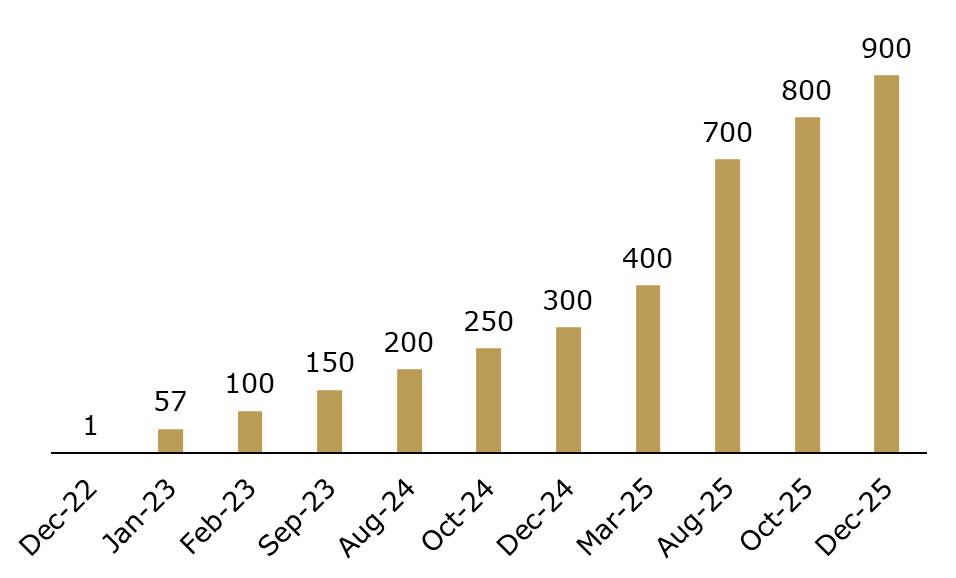

Many companies and individuals haven’t entirely figured out what they should use AI for, but they clearly want it anyway. Usage of ChatGPT and other AI tools has risen at an astonishing rate over a relatively short period. As of December 2025, ChatGPT had about 900 million weekly users, representing 10% of the world’s adult population, according to a study by OpenAI, Harvard University and Duke University.

ChatGPT Usage ExplodingWeekly Active Users (Millions)

Source: Kestra Investment Management with data from the Business of Apps AI Report, Axios, TechCrunch, Reuters, The Information, and Pew Research.

Fear, Optimism and the Jobs Question

Like other technological advances, AI has generated a mix of fear, optimism, and controversy. According to a recent Gallup survey, 61% of Americans believe it will eliminate more jobs than it creates. Interestingly, the survey also found that most Americans believe AI will boost productivity and economic growth.

We believe AI will continue to have both positive and negative economic impacts. Some of the impact will be tied to productivity gains, and some to what we call job relocation. While AI is likely to reduce the need for certain types of jobs, it should also create new opportunities. For workers, the key is remaining flexible — in other words, staying open to updating your skills, learning new ones and shifting to roles in high-growth areas.

Far and Wide

Investors have rewarded companies at the forefront of the AI race handsomely, pushing the stock prices of major cloud-service providers, and chip makers to dizzying highs. But if AI is to live up to its transformational promise, adoption must spread well beyond the tech sector, helping a much larger share of companies to become more innovative, faster growing and efficient.

“AI is one of the most important things humanity is working on. It is more profound than, I dunno, electricity or fire.”

Google CEO Sundar Pichai, 2018

It will take years to find out if such bold predictions prove right, but many companies have already jumped on the proverbial bandwagon. During the one-year period ending in the third quarter of 2025, the percentage of companies citing AI on earnings calls rose across every S&P 500 sector except Utilities, according to FactSet. Non-tech sectors, including Financials, Industrials and Materials, had some of the biggest increases in AI mentions on earnings calls.

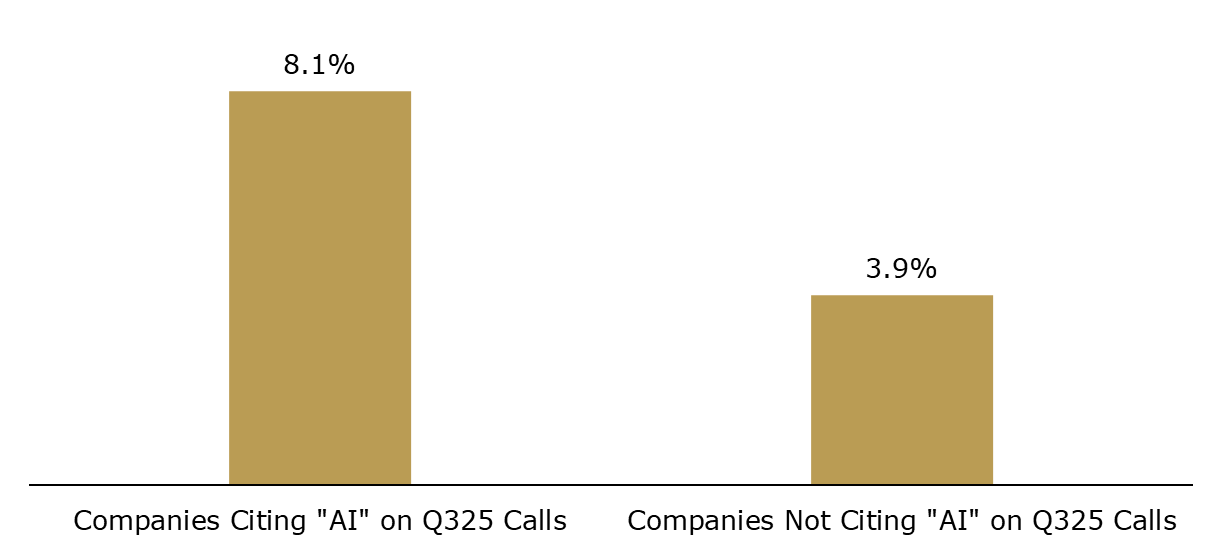

Investors are rewarding companies that are leaning into AI — or at least talking about it on earnings calls — contributing to the outperformance of certain stocks.

S&P 500 Stocks Average Price Change (June 30th, 2025 – December 5th, 2025)

Source: Kestra Investment Management with data from FactSet

Patent-application trends also show broad adoption across industries. Transportation, telecom, manufacturing, and life and medical sciences are among the industries leading the way in filing AI-related patent applications.

Manufacturing has been in a multi-year slump, which may help explain why the sector is bullish on the promise of AI. Deloitte recently surveyed 600 executives from leading manufacturing companies and found that a whopping 85% believe “smart manufacturing” will improve their competitive advantage, agility and just-in-time production, along with attracting new talent. Smart manufacturing blends automation hardware, data analytics, sensors and cloud-computing platforms to modernize production.

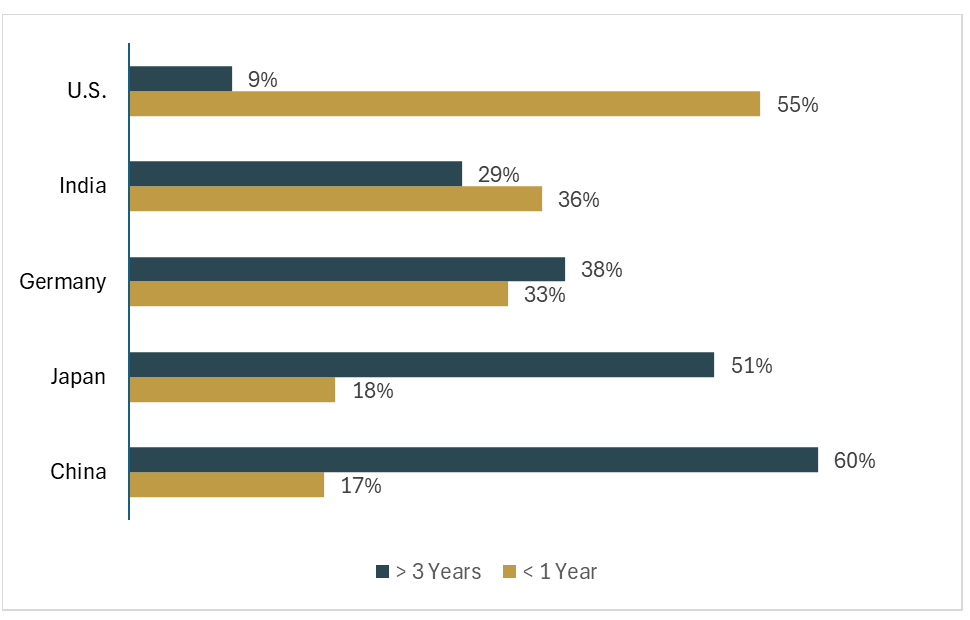

Enterprise Use of AI by Country

Source: Kestra Investment Management with data from TE Connectivity

Leading in Development, Lagging in Adoption

American companies have been at the forefront of developing AI, but they haven’t necessarily led when it comes to putting the technology to use. Some 55% of U.S. respondents who participated in a recent worldwide survey of engineers and executives said their companies have been using AI for less than a year. By contrast, more than half of respondents from China and Japan said their companies have been using AI for at least three years. The United States also falls short when it comes to individuals’ use of AI. It ranks 24th globally, behind Poland and Taiwan, for individual use of AI, according a Microsoft study.

Emerging markets, on the other hand, tend to be far more excited about the burgeoning technology. South Korea, for instance, set out to become an AI superpower. To that end, it is among the first countries to put a coordinated regulatory regime in place. Seoul is spending heavily on training programs, financial incentives for small and mid-sized businesses to adopt AI and other initiatives. In fact, South Korea is now the world’s second-largest paid market for ChatGPT, behind the United States.

How Do the Benefits Stack Up?

Despite concerns over AI’s impact on the job market, many companies are finding that it makes employees feel better about their jobs. A recent McKinsey & Company survey of firms using AI found that the top-three benefits are greater innovation (64%) and employee and customer satisfaction (45% on both metrics). AI may be helping to boost morale in the workplace because, among other things, it helps employees perform routine tasks more efficiently, freeing them to focus on more meaningful work and improving work-life balance.

In the McKinsey survey, the percentage of companies that derived cost savings (38%) was lower than we might expect. Cost savings has long been a selling point for AI but figuring how to extract meaningful savings from the technology isn’t necessarily intuitive.

Under the Dome

Many discussions about AI center on whether we’re in a bubble. It’s a valid question, but in some ways misses the bigger picture. As AI adoption grows, investors have more opportunities to gain exposure to companies and markets that stand to benefit over the long term. So, what happens in a single, highly valued corner of the equities market is perhaps less important than the broader trend.

Some observers have compared the AI phenomenon to a dome settling over the globe. The analogy seems to fit. As with past technological revolutions — from railroads in the 19th century to the dot-com boom, more than a century later — we don’t know how the companies building out the infrastructure will ultimately fare. But history suggests that everything under the dome will look different years from now.

Past performance is not a reliable indicator of current or future results. Indexes are unmanaged and not subject to fees. It is not possible to invest directly in an index. The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. Does not offer tax or legal advice.