Your complete financial picture, anytime.

Track your net worth, monitor investments, plan for retirement, set goals, and securely store documents — all in one place. Your personal financial website is available 24/7 on desktop and mobile.

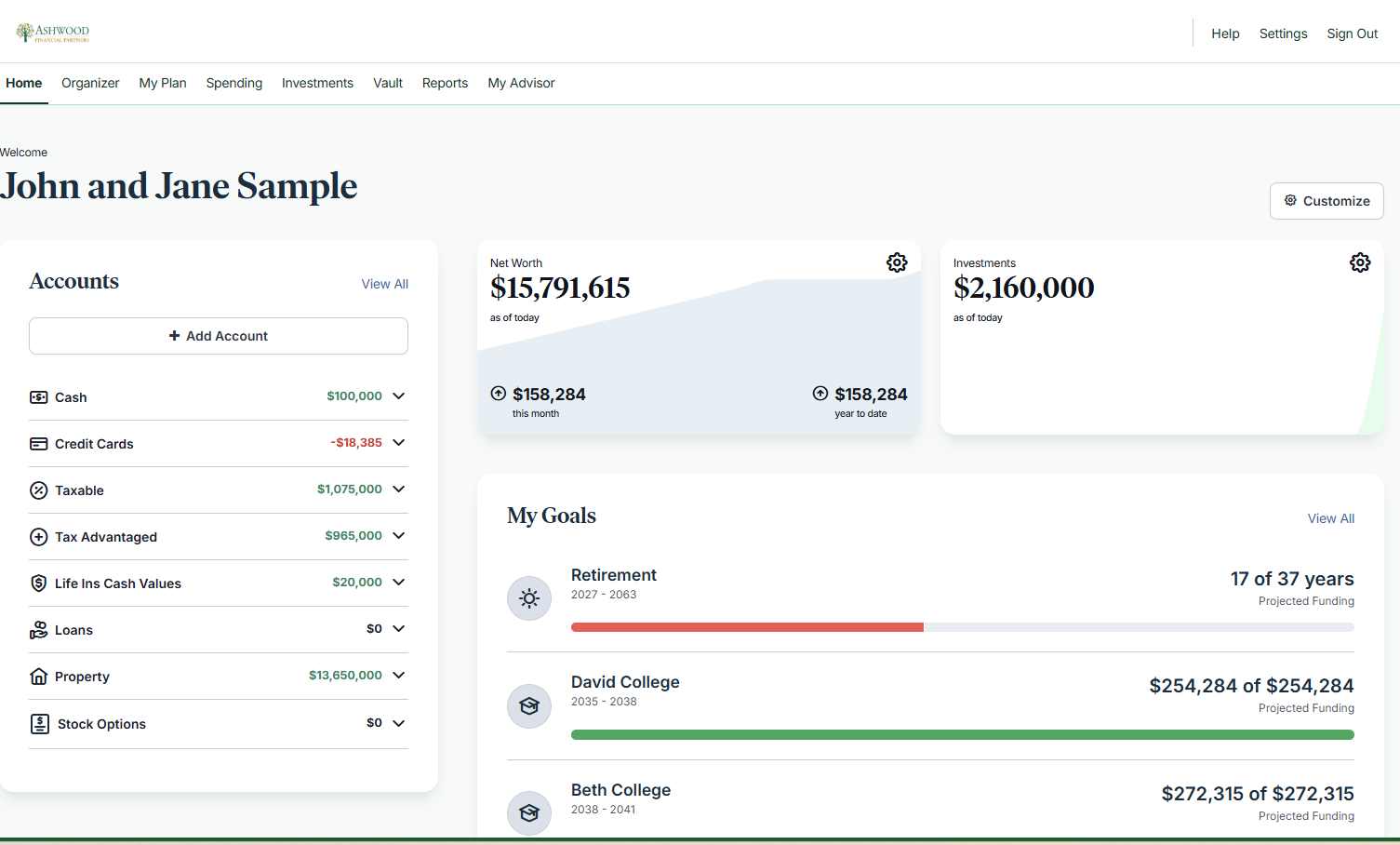

Your personalized wealth dashboard.

Here's what your Ashwood Wealth Portal looks like when you log in — a clean, intuitive dashboard built around your financial life.

Sample client view shown with hypothetical data for illustration purposes only.

A client experience built around clarity.

Your portal isn't a generic dashboard. It's a branded Ashwood experience designed to make your financial life feel organized, accessible, and transparent — so every conversation with your advisor starts from a place of shared understanding.

Intuitive Navigation

Eight clear tabs — Home, Organizer, My Plan, Spending, Investments, Vault, Reports, and My Advisor — put everything within one click. No searching, no confusion.

Everything at a Glance

Your home dashboard shows accounts, net worth, investments, and goals in a single view — so you always know exactly where you stand financially.

Real-Time Goal Tracking

Visual progress bars show how your retirement, education, and spending goals are funded — with projected timelines so you can see exactly where adjustments may be needed.

Shared Household View

Both spouses or partners see the same unified dashboard — ensuring alignment on net worth, goals, and investment performance across all joint and individual accounts.

Everything you need in one dashboard.

Your Ashwood Wealth Portal aggregates your entire financial life — accounts, goals, spending, investments, and documents — into a single, personalized view. No more logging into multiple sites or digging through file cabinets.

Net Worth Tracking

See your complete financial picture at a glance — assets, liabilities, and net worth updated in real time across all linked accounts.

Investment Monitoring

Track performance, review holdings, and see how your investments are working toward your goals — all in one view with interactive charts.

Goal Planning

Set and track retirement, education, and spending goals. See projected funding timelines and adjust as your life evolves.

Spending & Budgeting

Categorize transactions, monitor cash flow, and set budgets to understand where your money goes each month.

Secure Document Vault

Upload and store important documents — tax returns, estate plans, insurance policies — in an encrypted digital vault accessible anytime.

My Advisor

Reach your Ashwood advisory team directly from the portal. Send messages, schedule meetings, and stay connected between reviews.

Your portal adapts to what matters most.

When you first log in, choose the financial focus that's most relevant to you. Your home page will automatically customize to highlight the information you care about most.

Setting a Budget

See income, expenses, and net cash flow at a glance with category breakdowns for food, entertainment, housing, travel, and more.

Growing Wealth

Track your total investment value, month-over-month changes, and year-to-date performance with interactive growth charts.

Achieving Goals

Monitor progress toward specific goals — retirement, education, a home purchase — with projected funding timelines and dedicated account tracking.

What I'm Worth

A comprehensive net worth dashboard showing total assets, liabilities, and your overall financial position over time.

Set up your portal in four simple steps.

When you log in for the first time, a guided onboarding process walks you through everything. It takes about 15–20 minutes and helps us build a complete picture of your financial life.

Family Information

Tell us about yourself, your spouse, and your dependents so we can tailor your plan to your household.

Financial Accounts

Link your bank accounts, retirement plans, investments, and other assets for a complete financial snapshot.

Your Goals

Define your retirement timeline, education funding needs, and any major spending goals on the horizon.

Review & Finish

Confirm your information, and your personalized financial plan begins. You can update details anytime.

Your finances, right at your fingertips.

Download the eMoney Client Portal app to access your full financial picture from your phone. Available for iPhone and Android.

Mobile app features

- Full account aggregation and net worth tracking

- Push notifications for account alerts and updates

- Biometric login with Face ID or fingerprint

- Goal tracking and spending insights on the go

- Secure document vault access from anywhere

Institutional-grade security.

Your Ashwood Wealth Portal employs advanced security features and protocols to keep your data safe, private, and secure — every hour of every day, year round.

256-Bit SSL Encryption

Your data is scrambled using 256-bit Secure Socket Layer encryption — the highest level available today, and twice the standard followed by many financial institutions, including banks.

2-Factor Authentication

A dynamic risk-based fraud detection platform sends a verification code to your mobile phone, requiring two methods of identity verification before granting access to your account.

Routine Security Testing

Third-party security auditors — including TraceSecurity, Tenable Security, and White Hat Security — continuously identify and remediate vulnerabilities within the platform.

Non-Transactional

Unlike online banking or trading websites, your money cannot be moved, withdrawn, or accessed through the portal. It is a viewing and planning platform only.

Ready to see your complete picture?

Log in to your Ashwood Wealth Portal or contact us to get set up. Your full financial life, in one place.

Powered by eMoney Advisor

The Ashwood Wealth Portal is provided through eMoney Advisor, LLC, a third-party financial planning platform. eMoney Advisor is not affiliated with Ashwood Financial Partners, Kestra Investment Services, or Kestra Advisory Services. Account aggregation is provided for informational purposes only and does not constitute investment advice. Linked account values are provided by third-party data sources and may be delayed or differ from custodial statements. Always refer to your official custodial statements for the most accurate account information. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with Ashwood Financial Partners, LLC. CommunityVotes Richmond 2025 Platinum Winner — Award based on community voting; not indicative of future performance or an endorsement by any regulatory body. CommunityVotes is not affiliated with Ashwood Financial Partners or Kestra Investment Services.