Inflation, Goldilocks, and the Fed

With lower-than-expected inflation in the month of October, we may all be wondering if there are brighter economic days ahead. Read more about the impact of inflation and Fed rate increases on the economy.

Inflation Cools During October

Overshadowed by mid-term elections last week, the latest tabulation of inflation was released. Despite its relative absence from the headlines, inflation is by far the more important near-term driver of both stock and bond performance. With lower inflation, the Federal Reserve will be able to ease off the economic brakes—a bit—and potentially create a more hospitable environment for investors.

Why is Inflation Important?

Prices for both consumers and companies have been soaring at a rate not seen in decades. That rapid increase in prices makes it harder for companies to plan their operations. When companies pay more for goods, they can be hard-pressed to maintain their profitability without raising prices on consumers. Understandably, companies often loathe increasing prices for fear of alienating otherwise loyal customers.

Inflation also eats into consumers’ paychecks. For many individuals, paying more for gas, eggs, or electricity means having to pay less for something else. Higher wages have offset some of the price increases, but not fully.

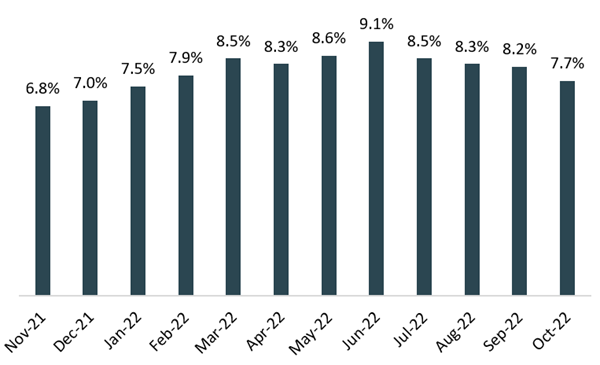

Consumer Price Increases - Year-over-year percent change

Source: Kestra Investment Management data from U.S. Bureau of Labor Statistics. Inflation in a selection of categories of the Consumer Price Index. Data as of October 31, 2022.

Think of the Federal Reserve as playing Goldilocks—trying to find the “just right” level of inflation somewhere between “too fast” and “too slow.” Policymakers aspire to some increase in prices that is relatively stable over time and one that runs below the overall level of economic growth. The Fed has argued that an inflation rate of 2%, in which goods and services in aggregate increase year after year at a moderate and predictable pace, is the most healthy for the economy. Interestingly, for years, particularly after the financial crisis, inflation was more likely to be below that target than above.

What About Economic Growth?

Investors aren’t just worried about the direct effects of inflation; they’re worried about the collateral damage from the Fed’s fight against rising prices. To combat inflation, the Federal Reserve has been raising interest rates, hoping to weaken economic demand. If, for instance, higher interest rates have made loans more expensive to pay for, then a company will be less willing to borrow money to, say, build a new factory. And a homebuyer will be forced to buy a less expensive house. Those forces in aggregate mean economic growth slows and sometimes turns negative, tripping the economy into recession.

Inflation: Shifting a Little Closer to “Just Right”?

In October, consumer prices rose by 7.7%, almost four times the rate of the Fed’s target and definitely in the “too fast” camp. But because that rate was less than economic experts had expected and lower than the prior month when prices rose by an even hotter 8.2%—stocks rallied as the S&P 500 posted its best one-day performance since April 2020, climbing 5.5%. Bond yields fell, anticipating that inflation will continue to ease and allow the Fed to be less aggressive in hiking interest rates and slowing the economy.

Inflation Shows Signs of Slowing

Source: Kestra Investment Management data from U.S. Bureau of Labor Statistics. Data as of October 31, 2022.

Slower inflation will make the Fed’s job easier, assuming this trend continues. With price increases moderating, interest rates won’t have to climb as much as some had feared in order to beat inflation back to that “just right” place. Considering that, the Federal Reserve is expected to raise interest rates by half a percentage point in mid-December—a rate that would be considered hefty in other cycles but is slower than other hikes this cycle, a positive for both stocks and bonds.

The hope is that with less dramatic interest rate increases from the Fed, economic growth will not slow as much as feared. All that said, the economy will continue to face headwinds from earlier interest rate hikes. The Fed’s brakes take a while to work their way through an economy and will continue to be felt for some time. But the market has already started looking past that slowdown to brighter days ahead and a “just right” level of inflation.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. Does not offer tax or legal advice.