The Rise of Active ETFs and the Implications for Investors

Key Takeaways

ETFs are no longer just passive, low-cost vehicles. Active management, leverage, and complex strategies now define a significant and growing portion of the ETF universe.

Choice and innovation come with tradeoffs. While product variety has increased, so have fees and structural complexity—raising the stakes for fund selection.

Advisor due diligence is more critical than ever. In an ETF landscape with growing complexity, maintaining portfolio discipline and aligning exposures with client objectives requires deep and consistent analysis.

For years, investing in an exchange-traded fund (ETF) meant investing passively in an index. ETF investors bought portfolios designed to capture the returns of an index, like the widely followed S&P 500, by matching the holdings of the index. This approached allowed portfolios to replicate the performance of the index, but gave up the prospect of outperformance. This is in contrast to active management, which attempts to outperform an index.

That convention reflected reality: regulatory and structural constraints made it difficult (often impractical) to deliver active management within an ETF wrapper. As a result, mutual funds remained the primary vehicle for active strategies.

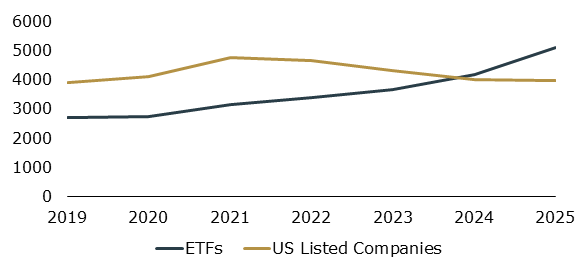

That paradigm shifted in 2019, when updated rules opened the door for active management in ETFs. Asset managers moved quickly to capitalize, and the market responded. With more than 5,000 ETFs now trading, surpassing the total number of publicly listed stocks, the investment landscape has become far more crowded than it was a decade ago. New product launches and asset flows reveal that ETFs have become the investment vehicle of choice, reflecting their success in lowering costs, improving tax efficiency, and broadening access to markets.

The ETF Landscape Has Shifted

Source: Morningstar Direct as of 12/31/2025. Number of US Listed Companies for 2025 is estimated based on IPO and delisting data from StockAnalysis.com.

The growing number of ETFs is not inherently a problem; rather, it signals that ETFs no longer simply representvarious swaths of the market. Increasingly, they express specific, tactical, and sometimes highly complex exposures. Need leveraged inverse exposure to a single stock? There’s now an ETF for that (but this is not a recommendation or advice!).

This explosion of choice, however, brings real challenges. Advisors and investors now face the daunting task of navigating thousands of options, often with overlapping mandates and varying levels of risk. The competition among issuers has intensified, driving product innovation but also encouraging the launch of more complex—and potentially higherrisk—strategies designed to justify higher fees and capture attention. For less experienced investors, these products can be difficult to fully understand.

The ETF market is fast approaching a tipping point. For advisors, this moment underscores the importance of conducting disciplined due diligence, ensuring portfolios remain grounded in fundamental investment principles amid an increasingly noisy product ecosystem.

Active vs. Passive: The Debate Takes a New Shape

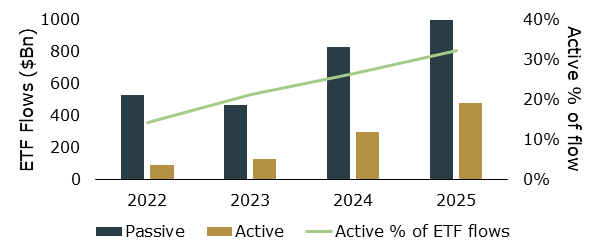

Asset managers have clearly responded to growing demand for active ETFs. In 2025 alone, more than 1,000 ETFs were launched, and roughly 900 of those products employed active strategies. This surge is not a one off event but part of a broader, multiyear trend in both product launches and asset flows. Active ETFs now capture a growing share of total ETF inflows each year, and momentum suggests that this shift is far from over.

Active ETFs Punch Above Their Weight

Source: Bloomberg, J.P Morgan Asset Management as of 12/31/2025.

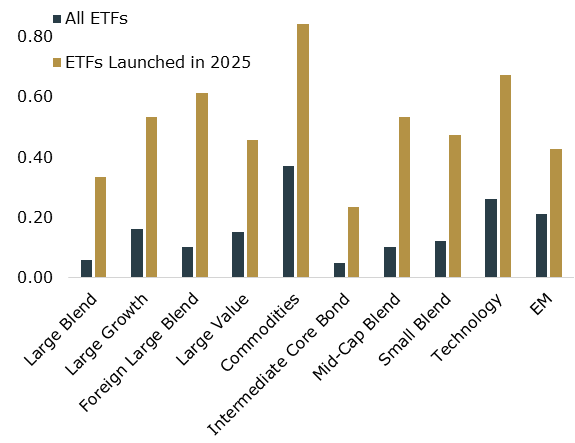

If the evolution simply reflected a rotation from passive to active management within ETFs, it might merit less scrutiny. But the broader ETF landscape is changing at the same time. Costs, for instance, are moving higher. Newly launched ETFs are meaningfully more expensive than their predecessors, particularly in popular categories where 2025 launches carried expense ratios two to six times higher than existing peers. For investors, the stakes have risen because of rapid product proliferation, rising fees, and increasingly complex mandates, reinforcing the need for careful evaluation of funds beyond headline labels.

Average Expense Ratios for ETFs Launched in 2025 Compared to the Category Average

Source: Kestra Investment Management using data from Morningstar Direct. Fund data as of 1/16/2026. Expense ratios are prospectus net expense ratios. Intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction.

OK, Things Are Different Now. So What Do We Do?

The ETF market has fundamentally changed, evolving from a simple, lowcost vehicle for passive exposure into a crowded marketplace defined by active management, tactical strategies, and rising complexity. While innovation has expanded the toolkit available to advisors, it has also introduced new risks—higher fees, overlapping mandates, and products whose behavior may diverge sharply from client expectations. As ETFs continue to outpace traditional vehicles in both launches and flows, the burden increasingly shifts toinvestors to separate useful tools from costly distractions.

In this environment, ETFs are no longer “plugandplay” solutions. Effective implementation now requires the same level of scrutiny historically reserved for mutual funds and alternative strategies. Success will hinge on disciplined due diligence, fee awareness, and a clear framework for determining when an ETF adds genuine portfolio value versus when it simply reflects product proliferation.As ETF complexity continues to increase, the real work for advisors will lie in establishing repeatable, disciplined duediligence processes. These frameworks must be robust enough to evaluate rising costs, growing structural nuance, and evermore targeted exposures—allowing advisors to navigate an expanding opportunity set without losing sight of portfolio fundamentals.

Past performance is not a reliable indicator of current or future results. Indexes are unmanaged and not subject to fees. It is not possible to invest directly in an index. The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. Does not offer tax or legal advice.